It’s been a crazy few weeks in the crypto news!

So far this week:

LBRY token was declared a security;

CoinDesk reported on FTX’s balance sheet

CZ announced he was dumping FTX, causing a massive run on FTT

FTX pauses withdrawals

SBF thanks CZ for considering the takeover of FTX

OFAC redesignates Tornado Cash

Ethereum burns all ETH issued since the Merge

Martin Shkreli tells Do Kwon “jail isn't that bad”

CoinDesk reported CZ will back out of the deal after seeing balance sheet.

So, how did we get here?

Turf war in DC. Sam Bankman Fried has been sponsoring a bill that essentially will create a bit-license at the federal level, and require intermediaries to register with the CFTC. The federal regulators have been interpreting the old laws as broadly as possible, but those laws were designed for transactions with intermediaries, and they just don’t fit today’s digital, decentralized landscape. Peer-to-peer crypto transactions can’t be effectively KYC’d, surveilled, reversed, or blocked. Instead of engaging with the community, and attempting to create some new laws that make sense, the regulators are engaging in disappointing regulation by enforcement.

Regulators. The US regulatory agencies are each trying to regulate the space in their own way. OFAC sanctioned the tornado cash code, and then walked it back yesterday, the CFTC went after OOKI Dao, and the SEC found LBRY tokens to be securities. Each regulator seems to be focused on a turf war over our exciting industry. They want their claim to fame that they prosecuted some big case, or made some meaningful regulations. If successful, the experience will likely get them hired at a large firm, for top dollar, at some future date.

DCCPA. SBF was pushing for the Digital Commodities Consumer Protection Act, (“DCCPA”), which would give the CFTC new regulatory authority over spot markets, which right now it only has fraud authority over the spot. The lack of authority over spot markets has long been cited as the reason there are no bitcoin-settled ETFs.

The CFTC just took a huge regulatory action against OOKI DAO, a non-custodial protocol, and they took that action under current law, without needing the DCCPA to back them up. The arguments made, if proven in court, would likely eliminate peer-to-peer trading for any type of staking or lending activities. The CFTC determined that (1) the Ooki tokens were commodities, (2) they needed to be traded only on a registered commodities exchange, and (3) that the Ooki DAO was an unregistered Futures Commission Merchant (“FCM”). To become a registered Futures Commission Merchant, entities would have to maintain adjusted net capital of at least 1 million, keep client funds segregated, keep a permanent record of client transaction histories, their name, address, and occupation, file SARs if needed, and file a monthly unaudited financial report to the CFTC. These requirements are just not compatible, or necessary for non-custodial peer-to-peer exchanges. Perhaps they do make sense for centralized exchanges, but exchanges registered in the US are already held to high standards by FinCEN, and the state banking authorities, especially in New York. This type of restrictive regulation in the Us, in fact, has pushed 95% of crypto trading overseas, where there are minimal rules.

SBF. Sam Bankman Fried, a sponsor of the DCCPA bill, published a tweet thread with a regulatory regime he thought made sense, but it was actually a lot more restrictive compared to what’s written in the DCCPA. One aspect that really upset the crypto community was when SBF said he thought the whole world should comply with OFAC regulations on every single transaction, which is completely outlandish and not aligned with the spirit of crypto and decentralization. For him, as the [former] operator of a centralized exchange, he had a lot of customers and fees to gain if defi could be crushed by regulations.

Eric Voorhees, the former CEO of ShapeShift and Satoshi Dice, wrote a blog responding to Sam’s tweets, and the discourse led to a debate on the Bankless podcast. The debate was hard to watch, Eric is an eloquent, thoughtful, and coherent speaker, and Sam couldn’t string a coherent sentence together.

After the podcast, some questions came to light that the FTX balance sheet was comprised largely of the FTT Token, which took a nearly 80% haircut today.

CZ, the CEO of Binance, began calling out SBF on twitter, suggesting that he should publish FTX & Alameda’s balance sheets. SBF said their balance sheet was fine, although he since deleted that [likely fraudulent] tweet.

SBF went to wall street looking for a $1b loan, and apparently, the hole is 5-6B.

The speculation is that SBF sent customer deposits to Alameda research. On the Bankless podcast yesterday, Erik said, “If that’s true, this needs to be the center example of the compliant exchange actually being riskier with customer money compared to non-compliant defi exchanges. That he would do that while going to DC and begging for more regulation to protect people. wtf”

The memes were out of control:

Celsius’s documents showed that Pharos, co-founded by Alameda Research, lost 83M with Celsius through Pharos USD Funds.

The CFTC quickly came out and said they will be monitoring the Binance/FTX transaction. The contagion risk is heavy on this, as outlined by degentrading (@hodlKRYPTONITE) - he suggested that CZ may bail out FTX, but likely will not bail out Alameda. Alameda has been borrowing from lenders and pledging the FTT token as collateral, which since CZ has already sold his position, will probably let it go to zero. This means lenders are underwater, and they’ve already taken heavy hits earlier this year with 3AC and Celsius. They will have to sell whatever they can, and more might go under.

Likelihood of deal: It already fell through.

Conclusion: Decentralized exchanges fix this intermediary risk. People can hold their own assets, and transactions are fully transparent and operate on code. Anyone in DC who actually cares about protecting people should promote self-custody. Sadly, this type of situation gives the takeaway that crypto is the wild west and needs policing. However, perhaps this situation can be an example of the industry settling its own issues. FTX’s insolvency was exposed by the market and maybe it will be solved by the market.

Comparison to the Bernie Madoff Case:

Early December 2008 - Madoff lost investors $64 Billion

December 11, 2008 - He turned himself in and his assets were frozen the next day.

March 12, 2009 - Madoff pled guilty to 11 federal charges of securities fraud, investment adviser fraud, mail fraud, wire fraud, three counts of money laundering, false statements, perjury, false filings with the U.S. Securities and Exchange Commission (SEC), and theft from an employee benefit plan.

March 18, 2009 - his accountant was sentenced to 17 years in prison.

On June 29, 2009, he was sentenced to 150 years of prison.

A hedge fund manager, a fraud victim, and his son committed suicide, his wife attempted suicide.

STATUTORY MAXIMUM SENTENCES

United States v. Bernard L. Madoff

OFAC re-designation of Tornado Cash

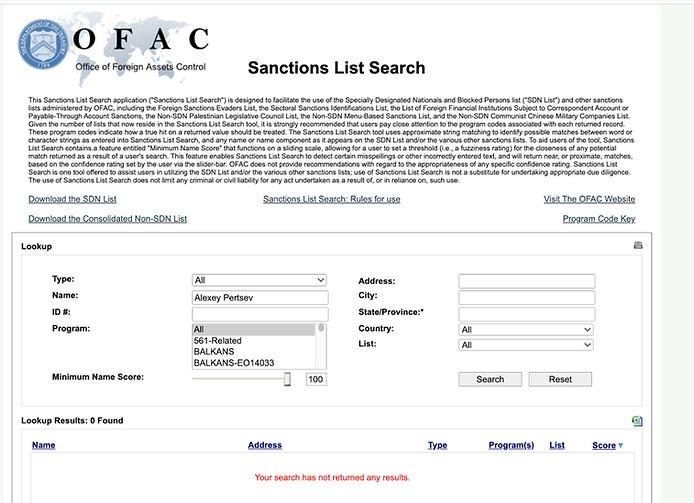

OFAC delisted and redesignated Tornado Cash, calling it an entity, and no longer restricting the 44 wallets it originally sanctioned back in August. Persons that engage in certain transactions with the individuals or entity known as Tornado Cash, may themselves be exposed to the designation.

OFAC updated FAQ 1078, and added the sentence, “To the extent, however, these ‘dusting’ transactions have no other sanctions nexus besides Tornado Cash, OFAC will not prioritize enforcement against the delayed receipt of initial blocking reports and subsequent annual reports of blocked property from such U.S. persons.” - OFAC also added FAQ 1095 which says Tornado Cash was designated as an entity, and not as code, “a partnership, association, trust, joint venture, corporation, group, subgroup, or other organization.” Tornado Cash’s organizational structure consists of (1) its founders and other associated developers, who together launched the Tornado Cash mixing service, developed new Tornado Cash mixing service features, created the Tornado Cash Decentralized Autonomous Organization (DAO), and actively promoted the platform’s popularity in an attempt to increase its user base; and (2) the Tornado Cash DAO, which is responsible for voting on and implementing new features created by the developers.

Notably, the founder, Alex Pertsev, has not actually been added to the SDN list though.